Should You Buy Sony Before Its Stock Split?

Over the last few years, many large technology companies have chosen to split their stock. Notable examples include Amazon, Alphabet, Tesla, and Nvidia.

However, more recently, a number of consumer goods businesses have also engaged in stock splits following sharp rises in share prices. Energy beverage maker Celsius and big-box retailer Walmart both did so within the last year. Fast-casual restaurant chain Chipotle Mexican Grill is on the verge of one, pending shareholder approval next month.

During its fiscal 2023 fourth-quarter report on May 14, Sony Group (NYSE: SONY) announced plans for a 5-for-1 stock split on Oct. 1. Shares of Sony's American depositary receipts (ADRs) will reflect the split-adjusted price.

So is scooping up shares of Sony a good idea right now?

What are stock splits?

Essentially, when a company splits its stock, the number of outstanding shares is multiplied while its stock price is divided by the same ratio.

In the case of Sony, the company's shares will increase by a factor of five while the share price will simultaneously be divided by five. Stock splits don't change the market cap of a company, nor do they do anything to meaningfully alter its fundamentals.

Image Source: Getty Images.

Has Sony ever split its stock before?

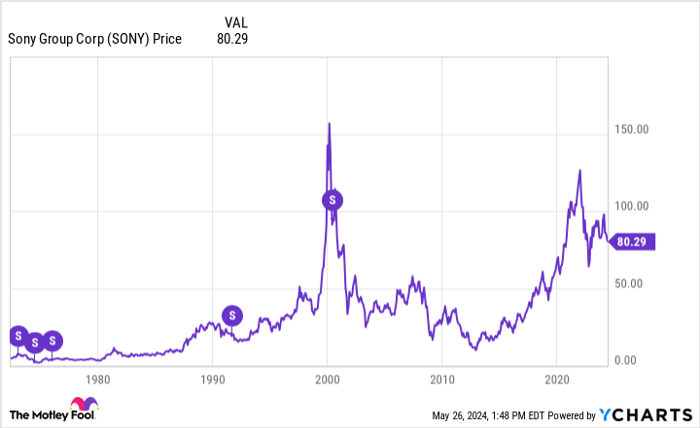

The chart below illustrates Sony's stock split history. Each split is annotated with a purple circle with the letter "S" in the middle. Sony last split its stock in early 2000. The historic stock prices shown are split-adjusted relative to the current number of shares.

Sometimes a company splits its stock because the share price has risen significantly and shares are perceived as too expensive. Retail investors can balk at lofty stock prices and choose to look for alternative opportunities.

A stock split may not change the company's valuation, but since shares are perceived as less expensive following a split, oftentimes, stock-split stocks enjoy surges in buying activity.

The chart above points out something pretty interesting. Sony's share price at the time of its last split 20 years ago was roughly $92 per share just after the split. Now, its shares are down by about 12% from that price.

Considering that Sony stock has generated a negative return since its last split and the stock is actually down about 15% so far in 2024, why might the company be looking to split shares?

Some things to keep in mind

Sony can accurately be characterized as something of a conglomerate. Its businesses include consumer electronics, music, movies, video games, and more. One tailwind that investors may not recognize applies to Sony is the artificial intelligence (AI) trend. Sony has a multitude of ways to benefit from AI, particularly as it relates to chips and consumer hardware.

While its multifaceted business provides Sony with diversification, the company is by no means immune to macroeconomic headwinds. Over the last few years, Sony's revenue has experienced some noticeable volatility. While that alone isn't necessarily a red flag, its gross profit margins and income have also fluctuated.

From an investment perspective, consistent ebbs and flows across both the top and bottom lines can be unnerving. I suspect these dynamics have contributed to Sony's stock price decline as investors have sought out more reliable opportunities.

Although this is understandable, I wouldn't move on from Sony just yet. One of the ongoing strategic moves underway at Sony relates to a divestiture. Specifically, the company will partially spin off its financial services unit in 2025. I find this move intriguing because companies often divest to become more agile and focus on higher-growth businesses, which, when done successfully, could bode well for investors.

Is Sony stock a buy before the stock split?

I think now is an interesting time in Sony's history. While I wouldn't say the business is in trouble by any means, I think some of Sony's moves will lead to more realignment overall.

Between the stock split, the spinoff, and secular trends fueling AI, I would not be surprised to see a new base of investors begin to buy up shares while they remain at depressed levels.

A prudent strategy could be to buy some shares of Sony before the split and continue monitoring the company's progress, especially in its ongoing spinoff plan.

Should you invest $1,000 in Sony Group right now?

Before you buy stock in Sony Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sony Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $703,539!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 28, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Adam Spatacco has positions in Alphabet, Amazon, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Celsius, Chipotle Mexican Grill, Nvidia, Tesla, and Walmart. The Motley Fool has a disclosure policy.

Popular Products

-

Rescue Zip Stitch Kit

Rescue Zip Stitch Kit$78.99$54.78 -

Gas Detector Meter

Gas Detector Meter$223.99$155.78 -

Foldable Garbage Picker Grabber Tool

Foldable Garbage Picker Grabber Tool$67.99$46.78 -

Portable Unisex Travel Urinal

Portable Unisex Travel Urinal$35.99$24.78 -

Reusable Keychain Pepper Spray – 20ml

Reusable Keychain Pepper Spray – 20ml$38.99$26.78