1 Big Retirement Savings Move That Should Pay Off Big Down The Road

My daughter just graduated from college and is preparing to start her first "real job." The other day she asked me: "How much money should I put in my 401(k)?"

What is a 401(k) and why is it a good idea?

If your first thought is: "What is a 401(k)?," here's an easy answer: A 401(k) is the most common retirement plan offered by U.S. employers. It works like this:

Your employer pays you a salary. Let's say it's $68,500 -- the average starting salary for U.S. college graduates in 2024. Your employer also offers you the option to reserve part of this salary, say 10% (or $6,850), and deposit this money in a 401(k) retirement plan. Because you don't get the money (right away), you don't pay taxes on it (right away). You'll pay taxes when you withdraw the money from the account in retirement. That's the first big benefit of opening a 401(k) retirement account: You get to defer some taxes.

How much money should I put in my 401(k)?

But now back to answering my daughter's question. You should put as much into your 401(k) as possible.

Why? First, because the more money you put in, the less you pay in taxes. Second, because your employer will often encourage you to fund your 401(k) by offering matching funds. This means that for every $X you put in, your employer will add an additional $Y into your 401(k).

Not every company offers a match, and for those that do, there may be limits. For example, if you're allowed to contribute up to 10% of your salary, your employer may only "match" the first 5%. Or your employer might offer to "match" $0.50 for every $1 you contribute.

But with any match, money in your 401(k) means free money your employer is adding to your retirement.

So put as much money into your 401(k) as you possibly can.

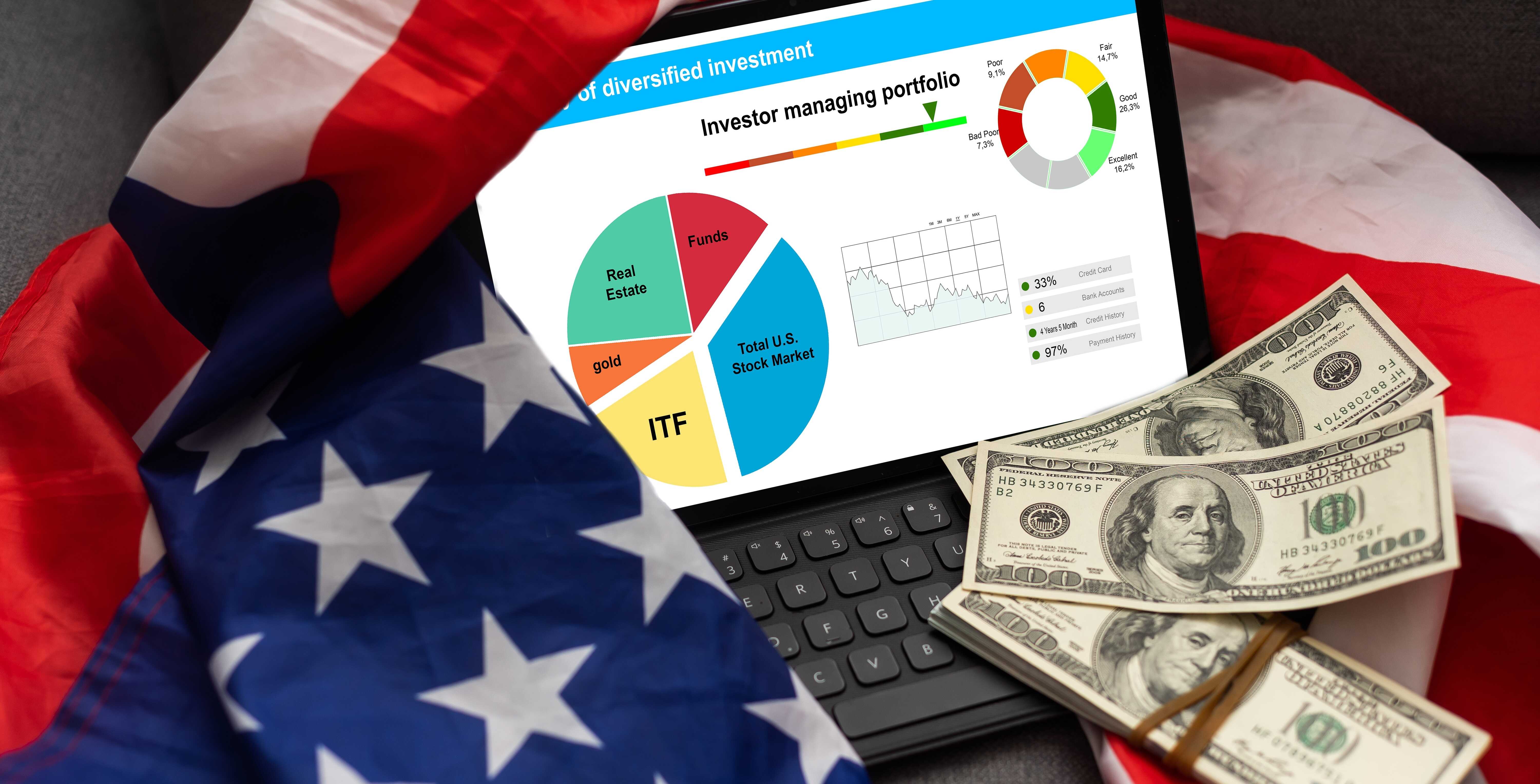

What stocks should you add to your retirement portfolio?

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now. The 10 stocks that made the cut could produce monster returns in the coming years, potentially setting you up for a more prosperous retirement.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $697,878!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

The Motley Fool has a disclosure policy.

Popular Products

-

Electronic String Tension Calibrator ...

Electronic String Tension Calibrator ...$30.99$20.78 -

Pickleball Paddle Case Hard Shell Rac...

Pickleball Paddle Case Hard Shell Rac...$20.99$13.78 -

Beach Tennis Racket Head Tape Protect...

Beach Tennis Racket Head Tape Protect...$43.99$29.78 -

Glow-in-the-Dark Outdoor Pickleball B...

Glow-in-the-Dark Outdoor Pickleball B...$50.99$34.78 -

Door Pickleball Trainer Rebounder

Door Pickleball Trainer Rebounder$104.99$72.78