Mtg Stock Lags Industry, Trades At A Discount: Should You Buy Or Wait?

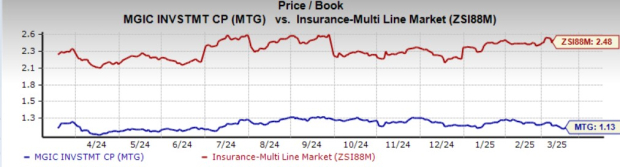

MGIC Investment Corporation MTG shares are trading at a discount to the Zacks Multi line insurance industry. Its price-to-book of 1.13X is lower than the industry average of 2.32X.

With a capitalization of $5.6 billion, MGIC Investment continues to benefit from credit performance in the mortgage insurance portfolio. With strong persistency rates and the current positive industry pricing environment, MTG expects in-force portfolio premium yield to remain stable.

Image Source: Zacks Investment Research

Shares of other insurers like Radian Group RDN are trading at a multiple lower than the industry average, while that of Arch Capital Group ACGL are trading at a multiple higher than the industry average.

MTG stock has lost 2.6% year to date, underperforming the industry and the sector’s return but outperforming the Zacks S&P 500 composite’s decline of 4.5%.

MTG Stock vs Industry, Sector & S&P 500 YTD

Image Source: Zacks Investment Research

MTG shares are trading below the 50-day moving average, indicating a bearish trend.

Based on short-term price targets offered by seven analysts, the Zacks average price target is $27.14 per share. The average indicates a potential 20.3% upside from the last closing price.

Growth Projections for MTG

The Zacks Consensus Estimate for 2025 earnings per share is pegged at $2.73, indicating a 6.2% year-over-year decrease on 3% higher revenues of $1.3 billion. The consensus estimate for 2026 is pegged at $2.86 per share, indicating a 4.8% year-over-year increase on 3.2% higher revenues of $1.3 billion.

MTG’s Favorable Return on Capital

Return on invested capital in the trailing 12 months was 11.4%, better than the industry average of 2%. This reflects MTG’s efficiency in utilizing funds to generate income.

Return on equity, which reflects the company’s efficiency in utilizing shareholders' funds, was 14.9% in the trailing 12 months, higher than the industry average of 14.4%.

MTG’s Northbound Estimate Revision Instills Confidence

One of three analysts covering the stock raised estimates for the current and next year. The Zacks Consensus Estimate for MTG’s 2025 and 2026 earnings has moved 2 cents and 5 cents north, respectively, in the past 30 days, reflecting analyst optimism.

Factors Acting in Favor of MGIC Investment

New business and solid annual persistency should drive the insurance-in-force portfolio. A higher level of new and existing home sales, an increased percentage of homes purchased for cash and an improved level of refinance activity should help MGIC Investment grow.

MTG has been witnessing a declining pattern of claim filings. A decline in loss and claims will strengthen the balance sheet and improve this mortgage insurer’s financial profile.

The largest mortgage insurer in the United States is improving its capital position with capital contribution, reinsurance transactions and cash position. Both leverage and times interest earned ratios have been improving.

A solid capital position supports MTG in wealth distribution. The company currently has $724 million remaining in its authorization kitty through December 2026. Its share repurchase activity reflects continued strong mortgage credit performance.

Parting Thoughts on MTG Stock

MTG has been seeing improving housing market fundamentals, such as household formations and home sales and the current capital status. Higher premiums, outstanding credit quality and new business will continue to induce growth for MCIG.

The last 13% increase to its quarterly dividend to 13 cents per share marks four straight years of dividend increases at a compound annual growth rate of 21% over that period. As part of wealth distribution to shareholders, this mortgage insurer also engages in share buyback, reflecting capital strength, financial results and share price levels that are expected to be attractive to generate long-term value for shareholders and thus had $372 million remaining on the current share repurchase authorization as of Jan. 31.

However, the mortgage insurance market is highly competitive with a few players holding significant market share. Along with the private players, MTG also faces competition from the Federal Housing Administration. Also, per J.P. Morgan’s report, the U.S. housing market is expected to grow at a very slow rate in 2025.

MTG also expects downward pressure on home prices to continue and further expects the overall market opportunity for new private mortgage insurance to be smaller.

Thus, it is wise to stay cautious on this Zacks Rank #3 (Hold) insurer. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MGIC Investment Corporation (MTG): Free Stock Analysis Report

Radian Group Inc. (RDN): Free Stock Analysis Report

Arch Capital Group Ltd. (ACGL): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Popular Products

-

Mommy Diaper Backpack with Stroller O...

Mommy Diaper Backpack with Stroller O...$106.99$73.78 -

-

Smart Auto-Recharge Robot Vacuum Cleaner

Smart Auto-Recharge Robot Vacuum Cleaner$472.99$306.78 -

Wireless Health Tracker Smart Ring - R11

Wireless Health Tracker Smart Ring - R11$94.99$65.78 -

Electric Hair Straightener and Curlin...

Electric Hair Straightener and Curlin...$116.99$80.78