Flowserve Benefits From Business Strength & Buyouts Amid Risks

Flowserve Corporation FLS is witnessing persistent strength across its Pump Division and Flow Control Division segments. Strength in the aftermarket business, driven by a strong demand for products and services in North America, Europe Middle East and Latin America, is a prime catalyst for the Flowserve Pumps Division segment’s growth (revenues up 3.1% year over year in 2024). The segment’s bookings increased 12.3% year over year in 2024 with a book-to-bill ratio of above 1.0x.

Healthy bookings across general industries and oil & gas end markets are supporting the Flow Control Division segment’s performance (revenues up 11.3% year over year in 2024). The segment’s bookings increased 1.8% year over year in 2024. For 2025, Flowserve expects total revenues to increase in the range of 5-7% from the year-ago level.

The company intends to strengthen and expand its businesses through acquisitions. In October 2024, FLS completed the acquisition of MOGAS Industries. The MOGAS acquisition will augment Flowserve’s existing valve and automation product portfolio and accelerate its 3D growth strategy by significantly boosting its direct mining and mineral extraction exposure. In the fourth quarter of 2024, this buyout had a positive contribution of 3% to its sales growth.

Management remains focused on rewarding its shareholders through dividend payouts. In 2024, the company used $110.4 million for distributing dividends and bought back shares worth $20.1 million. Also, it paid dividends of $105 million in 2023. In the first quarter of 2024, Flowserve hiked its quarterly dividend by approximately 5% to 21 cents per share (annually: 84 cents).

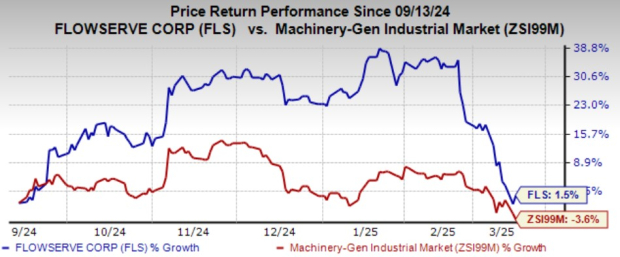

FLS’ Price Performance

Image Source: Zacks Investment Research

In the past six months, the Zacks Rank #3 (Hold) company has gained 1.5% against the industry’s 3.6% decline.

However, the escalating cost of sales and expenses poses a threat to Flowserve’s bottom line. For instance, in 2024, its cost of sales increased 2.6% year over year to $3.12 billion. The metric, as a percentage of net sales, was 68.5%. Also, its selling, general and administrative expenses increased 1.7% in 2024.

High debt levels raise financial obligations and hurt the company’s profitability. It exited 2024 with long-term debt of $1.46 billion, higher than $1.16 billion reported at the end of 2023. The company’s interest expense was $69.3 million in the year.

Stocks to Consider

Some better-ranked companies from the same space are discussed below.

RBC Bearings Incorporated RBC currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

RBC delivered a trailing four-quarter average earnings surprise of 4.9%. In the past 60 days, the Zacks Consensus Estimate for RBC’s fiscal 2025 earnings has increased 1.2%.

Applied Industrial Technologies, Inc. AIT presently carries a Zacks Rank #2 (Buy). It has a trailing four-quarter average earnings surprise of 5.3%. The Zacks Consensus Estimate for AIT’s fiscal 2025 (ending June 2025) earnings has improved 1.4% in the past 60 days.

The Middleby Corporation MIDD presently carries a Zacks Rank of 2. MIDD delivered a trailing four-quarter average earnings surprise of 1.9%.

In the past 60 days, the consensus estimate for MIDD’s 2025 earnings has inched up 0.8%.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

RBC Bearings Incorporated (RBC): Free Stock Analysis Report

Flowserve Corporation (FLS): Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT): Free Stock Analysis Report

The Middleby Corporation (MIDD): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Popular Products

-

Bloody Zombie Latex Mask For Halloween

Bloody Zombie Latex Mask For Halloween$98.78$61.82 -

Devil Horn Headband

Devil Horn Headband$24.67$10.46 -

WiFi Smart Video Doorbell Camera with...

WiFi Smart Video Doorbell Camera with...$44.99$30.78 -

Smart GPS Waterproof Mini Pet Tracker

Smart GPS Waterproof Mini Pet Tracker$43.99$29.78 -

Unisex Adjustable Back Posture Corrector

Unisex Adjustable Back Posture Corrector$51.99$35.78